I’m excited to share highlights from the inaugural Edge Computing Landscape survey conducted during the fall of 2021 and sponsored by ZEDEDA.

Why did we think it was important to sponsor this research?

Edge computing has gained momentum over the past several years, driven by the exponential increase in data and the need to analyze this data closer to the source to gain valuable insights. This trend further increased in the spring of 2020, driven by the COVID-19 pandemic, putting immediate pressure on organizations to find new ways of conducting business that enabled remote work, improved efficiency, and cut costs. As typical of any emerging technology, despite this growing interest there is also a lot of confusion in the market. We wanted to better understand the current state of the landscape through the eyes of our customers, partners, and industry insiders, and gain insights into their strategies, challenges, and future plans.

The audience for this survey included a wide range of verticals, including Automotive, Education, Government, Healthcare, Manufacturing, Oil and Gas, Renewable Energy, Retail, Technology, and Utilities. The audience also extended beyond traditional IT and included respondents from both OT and Line of Business (LOB) roles.

What were some of the notable findings?

Edge is now

The vast majority (74%) of survey respondents have an edge project underway today, with the majority of these projects (31%) being in the internal proof of concept phase. A similar number of projects (26%) are in the investigation and scoping phase, while a lesser number (23%) reported their projects were in full scale deployment.

From a vertical perspective, edge computing projects in the Manufacturing sector represent nearly a third (29%) of reported projects that are currently underway. The next highest representation was Retail (14%), with additional activity across a variety of industries including Utilities, Oil and Gas, and Education.

Competitive advantage is the main driver leading organizations to pursue an edge strategy

Organizations are turning to digital transformation to rethink their business and provide new services and revenue streams. The survey revealed that organizations believe that edge computing is an integral part of these efforts. Ensuring autonomous operation and lowering latency rounded out the top three drivers, signaling that the value of edge computing is in keeping the business running and facilitating competitive advantage through increased efficiency and agility.

Edge spending is increasing

When asked about current spending, 59% of respondents reported an annual budget of less than $500,000, but 77% said they expect to see much more or somewhat more spending for edge projects in 2022. Nearly three-quarters (74%) said they expected to see up to a 25% spending increase in 2022.

AI/ML is the leading application at the edge

The majority (69%) of respondents reported that they were considering running AI/ML applications at the edge. Additional applications include remote condition monitoring (53%) and cybersecurity (29%).

Security is one of the biggest challenges to implementing an edge project, followed by obtaining budget and device management

Survey respondents cited security as the most difficult challenge when implementing an Edge project. While respondents also recognize a host of other challenges, the intensity of the security challenge separates it from the others.

The survey did reveal a divide between those in Operations Technology (OT) and Information Technology (IT) on the issue of security, with more IT respondents expressing concern than OT. This suggests a potential disconnect that could stem from the two groups approaching the issue with a different definition of what security entails. While OT historically views security as a means to ensure uptime and safety, IT typically looks at it in terms of data and governance. These lines are blurring with the growth of IoT and edge, with more and more previously unconnected OT systems being networked to drive business value.

Budget and device management are widely seen as challenges as well. The divide between IT and OT-identified personnel appears again on budget, with IT seeing more of a budget challenge than OT. It’s possible that the deep foundation of OT in the physical world and with specific use cases tied to the business may lessen the budget challenges of OT organizations. Meanwhile, IT is often viewed as a cost center.

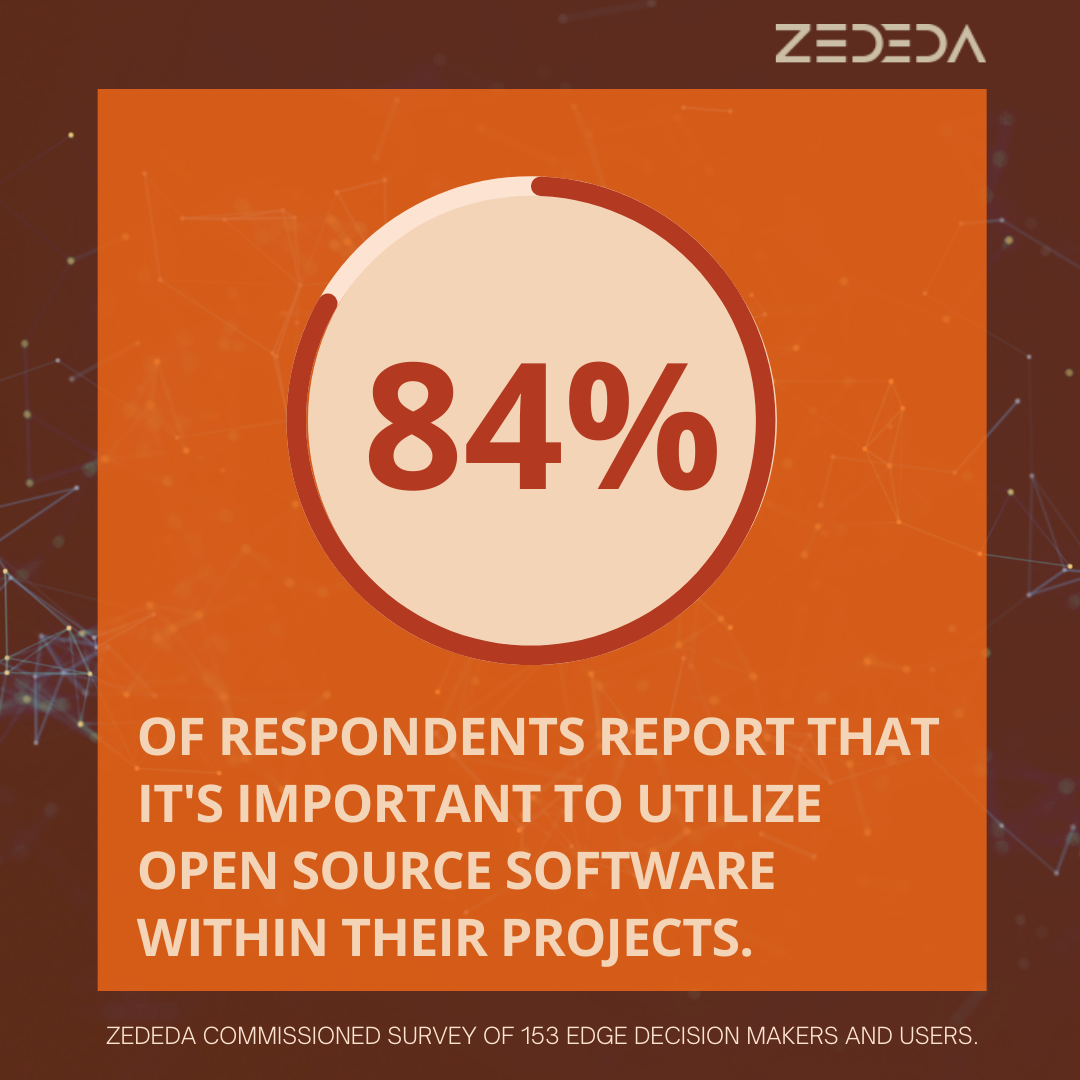

Vendor lock-in is a concern and open source software utilization is viewed as important

The majority (82%) of respondents reported that they were very or somewhat concerned with being locked-in to a particular solution provider. IT and LOB-identified respondents were more concerned (85%) about lock-in as compared to OT-identified respondents (69%).

Nearly the same proportion (84%) of respondents reported that it was important for them to utilize open source software within their projects. Both OT (88%) and IT-identified (83%) respondents cited this as more of a concern as compared to LOB-identified respondents (75%).

Investment in a multi-cloud strategy is important

The majority (60%) of respondents reported that it was important to them to invest in a multi-cloud strategy. When asked which cloud providers they relied on today, Microsoft Azure (35%) and Amazon Web Services (33%) were the most popular, followed by Google Cloud (15%).

OT-identified respondents were more likely to report leveraging the Platform as a Service (PaaS) capabilities (e.g., Azure IoT or AWS IoT) of their main cloud provider (57%) as compared to just 42% of IT-identified respondents. Conversely, IT was more likely to report leveraging the cloud provider as Infrastructure as a Service (IaaS) and relying on their own or external edge and IoT platform services (58%) as compared to 36% of OT.

Where do we go from here?

These survey results indicate firsthand that the edge computing industry is accelerating albeit still challenging to implement. As the edge computing industry matures, with organizations identifying the use cases, applications, and solutions that can help them move their projects into the field, we expect to see a flurry of activity across different verticals. In addition to net new edge solutions, organizations are modernizing their existing IT infrastructure, bringing connectivity to previously unconnected devices and increasingly consuming these solutions as a service. Edge computing enables these new architectures and business models with flexibility, security and agility.

To see the full findings and methodology, download the report here.